What is Your Company’s Story?

You’ve likely heard the expression, “a picture is worth a thousand words.” Or been moved by the ‘story’ an artist tells with canvas and paint. Accountants, on the other hand, aren’t usually known for their storytelling abilities–but that’s exactly what an exceptional accountant does.

We previously explained on the blog what makes for a good, a bad, or an exceptional accountant, including:

A deep understanding of financial principles

Extraordinary financial acumen

The ability to interface with critical external counterparties

Confidence to mentor colleagues

Scott Tindall, MBA, CTP

Advisor

In addition, exceptional accountants are also storytellers and the story they tell reveals insights about the business that almost nothing else can. An accurate, complete set of financial statements (balance sheet, income statement, and statement of cash flow: my top three) can be poetic. Accurately prepared data sets and financial statements are like different storylines that work together, slowly unraveling each other to reveal an overarching truth.

The story that exceptional accountants provide in the form of financial statements and advisory services provide an all-encompassing set of information that can be used by management or potential capital partners to highlight strengths and identify areas for improvement.

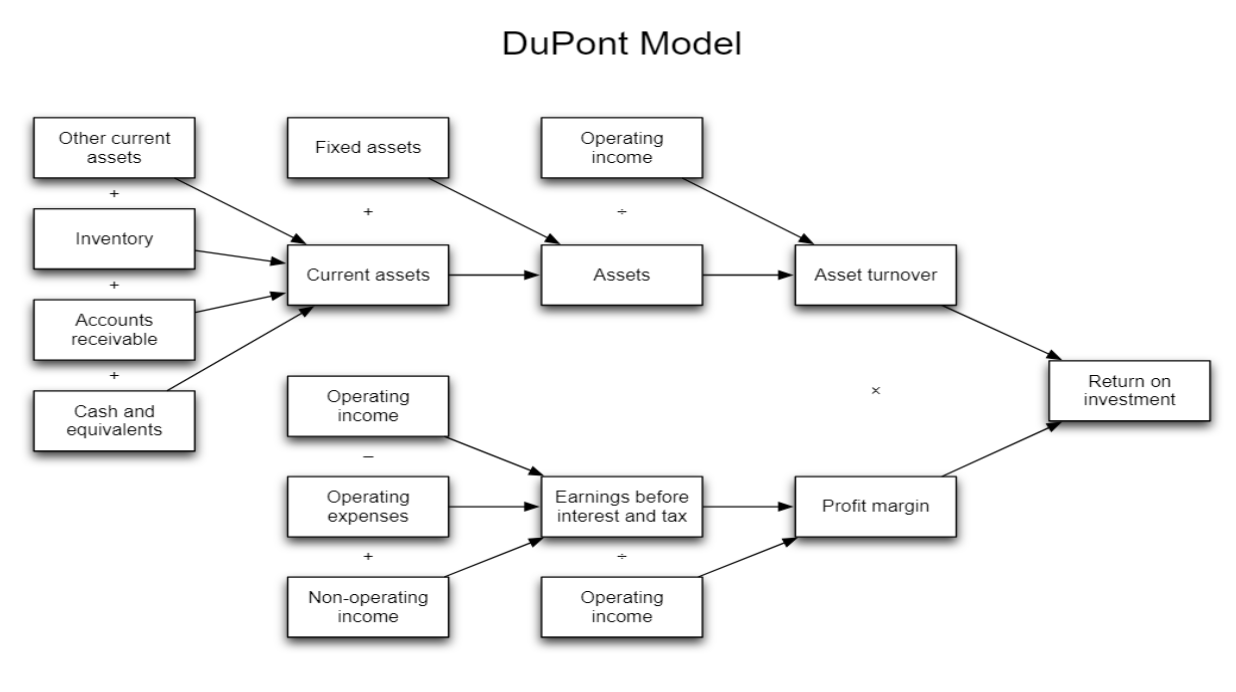

Initial analysis may include a discussion of gross margin, growth in assets, magnitude of COGS, net profit margin, and return on equity. In our current economic environment, it’s likely that interest expense (for those with debt) is also noteworthy. All well and good. However, an exceptional accountant will expand the story (via the DuPont model) to include lesser analyzed items such as asset turnover, degree of non-earning assets, and financial leverage. A complete story (analysis) provides both balance sheet and income components for a company’s ROE. Improvements or deterioration of key metrics will allow an owner to address items of concern.

Most importantly, a Breakaway advisor serves not just as a financial storyteller, but as an strategic partner, ready and willing to have honest conversations with their clients. Because while the first step is understanding what the numbers tell you about your business’s past, the most important part is deciding how to use that information to write your future chapters.

If you’re interested in learning more about what your numbers are telling you, contact us at info@breakawayba.com. We’d be proud to tell your company’s story!